what is the property tax rate in dallas texas

While the national average tends to fall between 108 and 121 Texas average effective property tax rate is above 183. The present market worth of real estate located within Dallas is estimated by county assessors.

Ad Find Dallas County Online Property Taxes Info From 2021.

. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. The following table provides 2017 the most common total combined property tax rates for 958 Texas cities and towns. The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700.

Dallas Property Tax Protest Service. The minimum combined 2022 sales tax rate for Dallas Texas is. El Paso City Council has approved a proposal to set the property tax rate at 862 cents per 100 of a propertys valuation.

DALLAS - Homeowners in Dallas could see the largest cut to their property tax rate in decades. Search Dallas County Records Online - Results In Minutes. The latest sales tax rate for Dallas TX.

In 2021 Houston San Antonio and. Did South Dakota v. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

According to the Tax Foundation that makes the overall state and local tax burden for. On top of that the state sales tax rate is 625. 2 hours agoAt the current rate of 773 cents per 100 Dallas has one of the highest property tax rates in the state.

Dallas County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. As part of the Dallass new budget city manager TC. Within Texas the Dallas combined property tax rate is on par with other major cities.

Ad No Fee Unless We Save You Money. Texas has no state property tax. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates.

Fort Worth and Houston are both slightly higher estimated rates are 2321 percent and 2259 percent respectively and San Antonio and Austin are slightly lower estimated rates are 2097 percent and 1973 percent. Homes are appraised at the beginning of the year and appraisal review board hearings generally begin in May. Dallas Mayor Eric Johnson has called for a tax rate cut to keep Dallas competitive with suburban cities.

53 minutes agoFOX 4. Toggle navigation DCTO Left. The County sales tax rate is.

There are a number of exemptions that help lower. We urge our customers to take advantage of processing their Motor Vehicle Transactions and Property Tax Payments online at this website. Wayfair Inc affect Texas.

What is the property tax rate in Dallas County. Dallas County has one of the highest median property taxes in the United States and is ranked 194th of the 3143 counties in order of median property taxes. In backing their plan both Broadnax and Johnson have pointed to a proposed reduction in the citys property tax rate --.

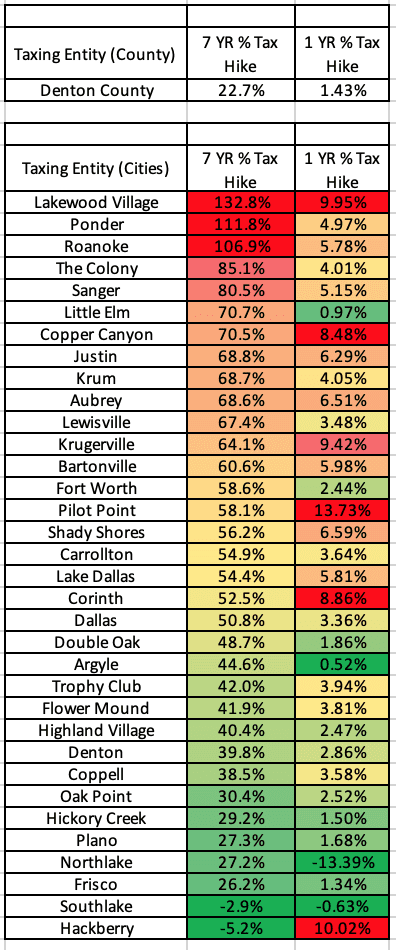

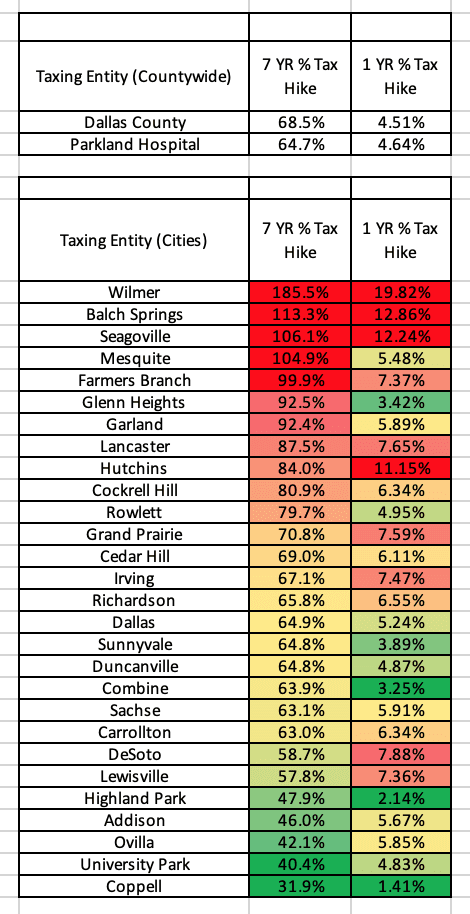

Texas citiestowns property tax rates. Dallas establishes tax rates all within Texas constitutional directives. Learn about Dallas metro property tax rates - Property tax rates for all major DFW metroplex citiestowns school districts and DFW metroplex counties.

As of the 2010 census the population was 2368139. By Dallas Morning News Editorial. This is the total of state county and city sales tax rates.

Due to property value growths rates will be going down quite a bit while assessments are still statutorily limited to a 10 increase. Texas Property Tax Exemptions. When compared to other states Texas property taxes are significantly higher.

The median property tax also known as real estate tax in Dallas County is 282700 per year based on a median home value of 12970000 and a median effective property tax rate of 218 of property value. 2 hours agoDallas TX 101 Dallas TX. Broadnax proposed a property tax cut of.

All property is appraised at full market value and taxes are assessed by local county assessors on 100 of appraised value. Property Tax FAQs Tax Rates Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone. Dallas County is a county located in the US.

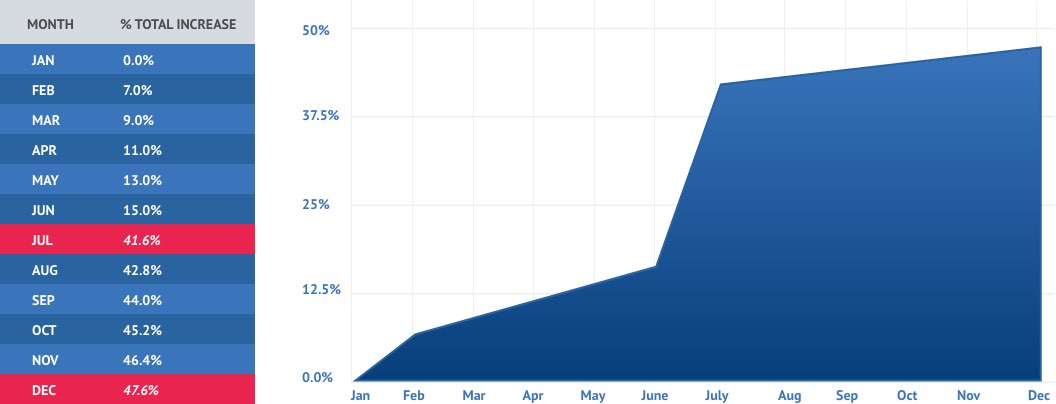

Typically property tax rates do not change drastically year to year. There are no obvious changes in rates from 2020 to 2021. 2020 rates included for use while preparing your income tax deduction.

Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services. This is the case this year. Complete lists of Texas school districts and counties are shown by clicking on these Texas school districts property tax rates and Texas counties property tax rates jump links.

This rate includes any state county city and local sales taxes. Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and uniform setting tax rates and. The Dallas sales tax rate is.

However left to the county are appraising property mailing billings bringing in the tax conducting compliance programs and clearing up discord. Need Assistance Paying Your Texas Property Taxes. Ad We Will Pay Your Residential or Commercial Property Tax Bill in Full.

Dallas County collects on average 218 of a propertys assessed fair market value as property tax. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. The Texas sales tax rate is currently.

The county adopted a new tax rate of 228 cents per 100 of assessed property value down from. Ive been telling you baws all year this is going to happen. What is the property tax rate in Texas.

200 AM on Apr 27 2022 CDT. For example the Dallas ISD rate is going from 1248 to an estimated rate of 8046 to be finalized at the end of the month.

Are You Overpaying On Your Property Taxes Property Tax Tax Reduction Tax

Looking For Dollar Saving Ideas In Rental Investment In 2022 Property Tax Investing Tax Reduction

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Which Texas Mega City Has Adopted The Highest Property Tax Rate

If Dallas Property Tax Rates Are Going Down Why Are My Payments Going Up Mansion Global

Buying Or Selling Irving Tx Real Estate The Timing Couldn T Be Bette Dallas Real Estate Real Estate Real Estate Marketing

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

How To Choose A Top Celina Realtor To Sell Your Celina House Celina Luxury Real Estate Agent Dallas Real Estate Dallas

Dallas Market Report Collin County Real Estate Market May 2022

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Cypress Texas Property Taxes What You Need To Know

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard